Reviewing Intel's Split: Part II

Commodification and Innovation, with Clayton Christensen

Continuing the review of Intel’s chip design revolution in the 1980s and how it relates to Intel’s split. In Part I we used a Wardley Mapping lens to describe the evolution that contributed to Intel’s decades of success, and their current position. Here in Part II we will look at it through Clayton Christensen’s lenses of innovation theory and the Law of Conservation of Attractive Profits.

Clayton Christensen’s theories

Professor Christensen’s innovation theory is a commonly explored phenomenon. Sustaining innovation is continually improving an existing product: adding new features, more advanced capability, even refining it. This is generally done by an incumbent; they have built their business on being very good at enhancing this particular product. It is worth emphasising that this is genuine innovation that powers the company’s economic engine and boosts its value.

Disruptive innovation, by contrast, occurs when a new product emerges which frankly appears to be less good overall compared to traditional products. The disruptive product is usually less capable, does not perform as well according to traditional measures, offers lower margins, and addresses a smaller market (though importantly: a new market). Disruptive innovation nearly always comes from a new entrant.

Over time, the disruptor ends up displacing the incumbent. The incumbent’s product continues to move further beyond the sweet spot of cost and benefit for more of the market, becoming more complicated and often more expensive; though measurably improving. The disruptor’s product, starting as the preferred choice for a new market of customers, moves into that sweet spot for more of the market, while also increasing in capability and performance, and expanding its margins.

At the end of the process, the product offerings themselves tend to look quite different to those available when it started, and the traditional measures of performance are no longer relevant; hence “disruptive”.

The Law of Conservation of Attractive Profits is simply stated: when a component of the value chain becomes commodified and its attractive profits disappear, the opportunity for attractive profits generally emerges at an adjacent stage of the value chain.

Intel’s recent history

Returning then to Intel, their CAD revolution of the 1980s was a sustaining innovation that enabled them to continue to fulfil their own promise of continuing Moore’s Law. Their tightly integrated value proposition included the CAD tooling, called RLS, that enabled their engineers to produce ever more complicated and dense designs. What changed was that over time, this same CAD tooling became commodified by the industry.

Already as Intel was advancing RLS the Electronic Design Automation (EDA) industry was getting started building commercial versions of the same. The “magical and powerful triumverate” that powered Intel’s RLS was adopted by the EDA industry, and was first applied to the design of Application-Specific Integrated Circuits (ASICs) - by definition, simpler products and also with a smaller adjacent addressable market.

The improvement of commercial EDA tooling has continued over the years, rising from ASICs to SoCs, and commodifying Intel’s RLS innovation1. Now Intel’s Foundry Service will support the EDA standards of Synopsis and Cadence, the two largest EDA companies, as well as that of their own RLS system.

Further, Intel’s split into design and foundry is an adjustment to where the much of the industry is already settling. Notice the chip designers such as ARM, nVidia and Apple on one side and foundries such as TSMC on the other2.

The disruption and the attractive profits

How do we map this history to the Professor Christensen’s theories?

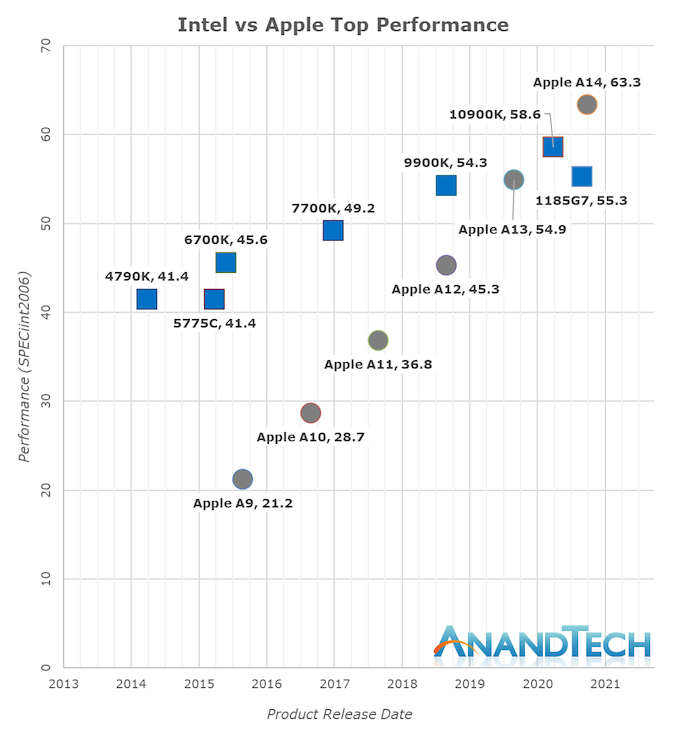

Intel’s CPUs have been disrupted by ARM derivatives, most notably Apple silicon. James Allworth gives a great take - most striking is the comparison of two charts, one showing a trajectory disruptive innovation, and the other showing Intel vs Apple performance. Notice the similar shapes.

One element of this disruption is the aforementioned commodifying of Intel’s RLS system by the EDA industry. Following the Law of Conservation of Attractive Profits, chip designers and foundries are independently accumulating value rather than the fully integrated solutions.

Back to the future

At the risk of abusing the concepts, there are a couple of ways to apply these theories to Intel’s organisation back in the 1980s.

For example, from the outside of the company the RLS system was a sustaining innovation as they enabled Intel to continue offering advanced innovations to the same products in the same market. However, looking internally the innovation was disruptive. The new methods were limited and constraining, only a subset of designers wanted to (or were able to) use them, and then over time they ended up reshaping how chip design was done.

As a related example, the Intel paper describes a commodification causing a modular split in the design chain: the introduction of logic design cells.

Using a cell library was an example of higher regularity. Hierarchical decomposition (“divide and conquer”) was achieved when complex problems were divided into independent pieces (e.g. separation of logic verification from timing verification, separation of logic synthesis from library mapping). This decomposition led to specialization in the expertise of engineers: for example, due to RTL and synthesis, logic designers have become programmers.

Rather than “wild creative freedom” in detailed design, designers were forced to used standardised, or commodified, logic cells. Creative freedom and new value (as a stand-in for attractive profits) then accrued at the neighbouring stages of the value chain - lower level in fabrication and higher level in logic design.

Boldly introducing the commodification of design bottlenecks, and going through a period of disruptive internal change brought these revolutionary changes to the industry, decades of success, and set up incredible improvements across society.

Closing

I find these theories a compelling way to look at business and technology evolution. In this one case study we have seen how they map to Intel’s own behaviour back in the 1980s that was a precursor to a period such incredible change in human history. And at the same time, the seeds were planted for those same effects to cause the same industry to disrupt them several years later.

Let us learn the lessons of these theories, see these effects correctly, and have the courage to embrace them.

-

It’s not fair to say that these tools are exactly commodities in the sense of electricity or Internet connectivity. There is still differentiation between products, and feature innovation. However, they are a long way evolved from their genesis in university labs and pioneering design teams, and there is a level of substitutability between the products. ↩︎

-

Samsung is an interesting case study. For advanced semiconductors Samsung has divided their business into System LSI for fabless chip design and Samsung Foundry for fabrication. They maintain an integrated business unit for memory, though it might be debated that a) memory is sufficiently different from CPUs/SOCs to be outside this conversation; and b) Samsung’s memory business is most similar to a foundry-style business in terms of how it generates value. ↩︎